Welcome to Part II of the Roman Laws of Crypto!

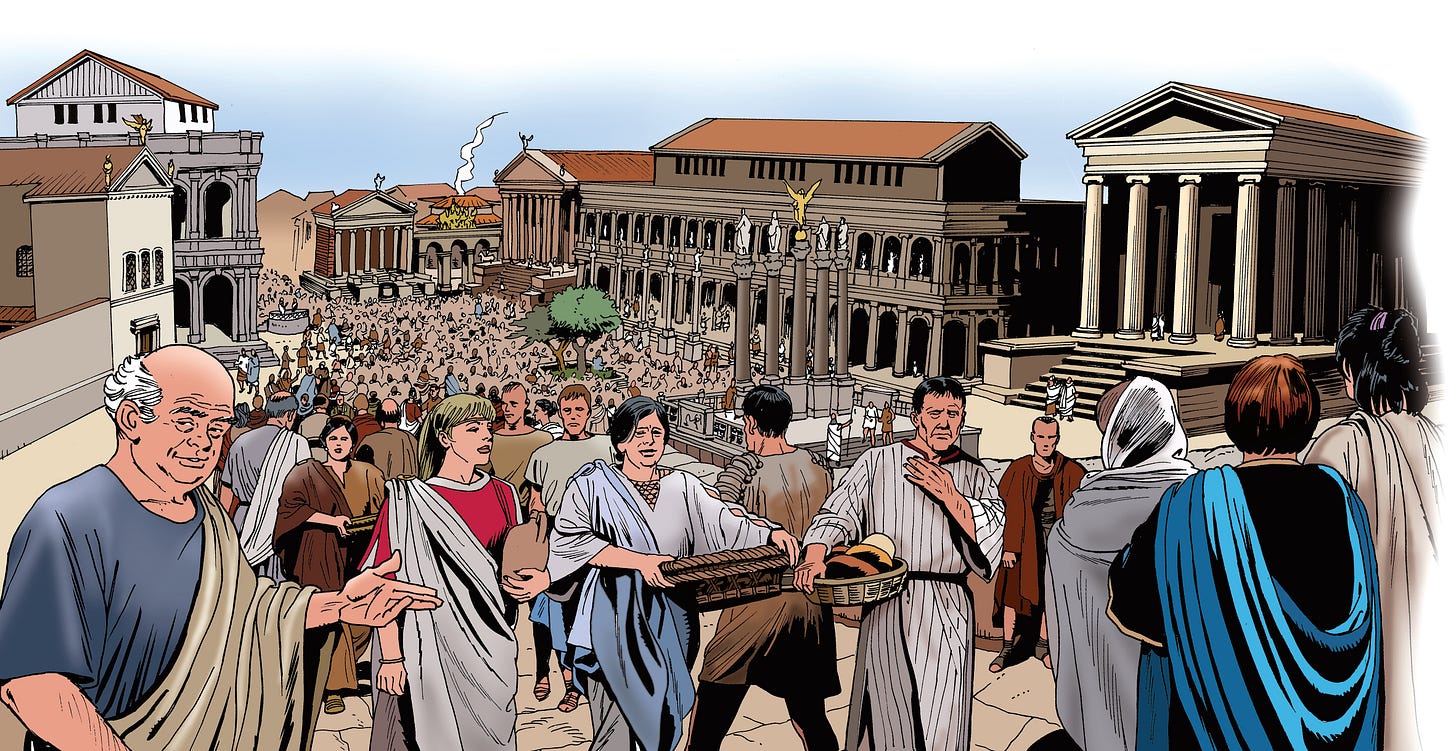

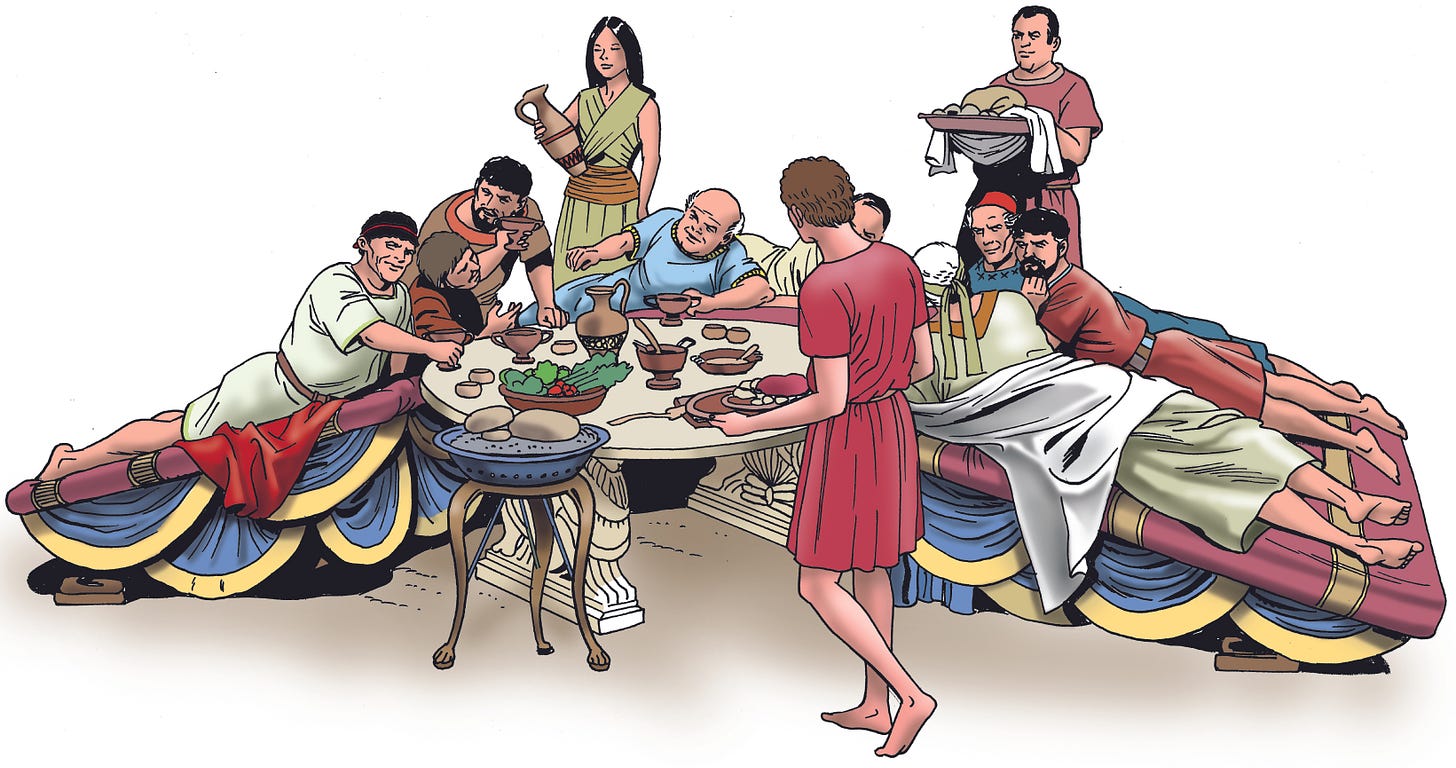

It’s not easy getting drunk on watered down wine, and chowing down on wild game from the provinces. You have to be able to collect the taxes and trade duties. Similar to the current crypto world - there were no guarantees that you would get paid. Worse still, if it was believed that you were a nation unable to collect - well it just meant that you weren’t going to have any money. Let’s use the big old US of A as an example.

Currently the USA and many other nations of the world are stuck in the process of how best to monetize the crypto/web3 evolution. How do you efficiently collect from an economy that does not reside in any particular borders, or specific region. Yes, there are certain trade routes - e.g. through Binance, FTX, PayPal or other centralized exchanges that may, or may not help you collect, but most likely you’re going to have to figure out your own method. This is the purpose of this article - and I promise you we’re going to find some ways to collect from those Plebs…er I mean Token Holders!

If you missed Part 1 - please click here to read it, but these don’t necessarily have to be read in order. I’m writing for a certain publication now so I’ve had to slow down a bit on the Roman stuff, but it’s still where my heart is at the moment.

In this article I’m going to present thoughts on fee collection, Optimism DAO stuff, incentives, DAO apathy, more tribunes, Roman patronage, and voting tokens. I’m trying to provide as many solutions as possible, but beware I’m not Emperor-level at this stuff quite yet. It’s my pleasure to present Roman Laws of Crypto II!

Taxation - aka Fee Collection

Below is a map showing the 42 +/- Roman provinces at the greatest extent of the Roman empire. Don’t worry you won’t have to memorize them, but I will call to them for certain examples of regional boundaries, visualization, or just because the map is so damn cool. There are choke points; mainly rivers, oceans and bridges, although you could argue the same choke points exist in the crypto ecosystem - albeit more similar to rivers of tokens and liquidity, than actual physical landscapes.

So how do you collect fees when you don’t have physical access to the people that are travelling your economy without paying their Roman denarii?

The denarius contained an average 4.5 grams, or 1⁄72 of a Roman pound, of silver, and was at first tariffed at ten asses, hence its name, which means 'tenner'.

Romans had a terrible system of tax collection - they farmed it out to public contractors; whomever bid the highest price gained the right to collect ‘taxes’ in the region they were bidding on. You could argue this is similar to a nation like the U.S. government hiring a firm like Chainalysis to collect crypto taxes. Let us pray it never comes to this.

Public contractors were universally hated in Roman times, mostly since the reason they bid for the rights to collect taxes in a certain region was due to the fact that the rules allowed you to squeeze whatever you could from said region after Rome had been paid the highest bid amount. Think civil forfeiture-type levels of tax collection.

My Legion is bigger than your Legion

As I’ve been slowly working away at my new apparent career as an underpaid, crypto-governance writer; the $LUNA $UST fiasco has been in full swing. It just goes to show that the greatest threat to governance is ——> large armies of liquidity. Rumor has it that Citadel borrowed 100k of BTC, traded 25k BTC for UST, opened a BTC short, started dumping 75k BTC aggressively, then after BTC went down; started dumping UST to make it lose the peg. Kwon was forced to sell 25k BTC at a major loss to recover peg, further dumping the price of BTC. Citadel shorting all the way.

Recently Nansen posted that it wasn’t a lone wolf pile of liquidity after all, but the threat is the same.

Moral of the story. You need to be able to act quickly to defend against this kind of overwhelming Hannibal-style attack (think elephants, not whales). Future crypto governance needs to be almost instantaneous in it’s ability to fend of these sort of heavy handed attacks. We must be nimble, we must be quick, we must be well governed for the brutal crypto future.

The whole idea of DAOs to most of the people who would be smart, and savvy enough to read this article (Hey big subscriber!) is to simplify systems of getting shit done.

We need better systems of tooling, and they are definitely on the way! Think messaging, notifications, multi-sigs and so on.

Bridges

Probably the more easily called upon comparison. I’ve had discussions with other crypto folks about how the easiest fee system for crypto might just be built-in fees at the choke-points. Just send a fractional amount to whomever is giving crypto the jurisdictional, legal, and international support it requires. Hell, it’s probably going to end up being the Swiss again - those neutral bastards in the mountains are going to fill up those vaults.

I think in some respects attempting to tax the crypto financial system is impossible, asinine, or just plain bad news. Make it easy, swipe left/swipe right and the fee is already included in the payment. Your country’s government didn’t sign on to the crypto Charter? Sorry no fee for you! Soup Nazis rejoice.

Crypto Charter! WTF is that?

Honestly I’m not sure yet, I’ve just started writing again, and these are thoughts that come out of my head. I wouldn’t say I have the most extensive financial experience, but I do have it where it probably counts the most. I’ve been the owner of my own construction business for almost twenty years now. Trust me, you have to deal with a lot of shit.

I was recently speaking with @P_H_B_D on a Brave Talk call and we got into all sorts of good discussion about the lack of tooling in DAOs and just how basic, and unpolished the governance is. Mind you we weren’t ripping on it, it’s just we were trying to figure out the best methods to deal with this once in a lifetime opportunity to have fundamental worldwide improvement in the way we organize as the human race.

I’m probably going to have to create a new graphic as we started talking about a Super DAO, or world DAO - to be fair it wasn’t at all the full thrust of what we were discussing it was just that it really does trickle down into everything we do.

Are DAOs Just Investment Platforms?

DAO - Decentralized Autonomous Organization.

No, DAOs in my opinion are every digital decision you ever make abstracted into the simplest decision making trees. Just like NFTs we like to think of them in their earliest and simplest forms (e.g. pfps, photos, art), yet they are powerful tools for mathematical solutions. They let us use passwords and identification through tech like ZK-Proofs without having to send the actual passwords and identification to the requesting party. Yes, it’s that powerful.

DAOs in my mind are actually a lot like the constant shifting legion sizes in Roman military culture. You see in antiquity communication was going through a seismic shift - especially military communication. When the barbarian hordes (Franks, Germans, Huns) got organized and too large to contain with outposts and walls the Romans were forced again in the 3rd Century to find better ways to organize and mobilize their legions. DAOs are the same solution for humanity in regards to globalization. Otherwise we’re going to end up with lots and lots of thought leaders, and I think we can agree to pass on that sort of empty virtue signaling to the bottom feeders.

It’s not very hard to imagine a world where friends and family are constantly interacting with DAOs - not the DAOs of today mind you. The fully tooled DAOs of tomorrow where all the decisions of today have the bullshit minutia removed.

I don’t want to jump too far into the tooling ideas in this part of the story, but think of all the steps it takes to pool together money and organizational mustard to achieve the following:

going with friends to a show/event

split-paying for a ride-sharing service

setting up a wedding/funeral

donating to charity and/or seeing the money go to work

volunteering, or organizing a collection event

collecting receipts for taxes that are to be paid by a business/organization

polling constituents/voters

dealing with your city/county

voting on pretty much anything

dealing with your local school system of any level

The Optimism Collective

After my article came out on Substack two people sent me the below tweet.

Either I work at Optimism, or great minds think alike. I’m happy to see even the smallest attempts at inspired governance, or more importantly; token holder initiatives and rights. Although the current setup is a bit vague and I feel like we’ve somehow entered this bizarro-world where state governance policy is suddenly in vogue.

Taking a peek at what rights Token Holders (Citizens) would actually wield:

4. Rights of OP Citizens and OP Holders. Subject to the founding legal documents of the Optimism Foundation and the procedures outlined in the Collective’s Operating Manual:

Future OP Citizens may:

Allocate Retroactive Public Goods Funding; and

Exercise such additional rights as are provided to OP Citizens over time.

OP Holders may:

Remove a director of the Optimism Foundation; and

Veto changes to the founding documents of the Optimism Foundation, if those changes would reduce the rights of OP Holders in a material way.

This actually calls a lot to what I was discussing with @P_H_B_D via DMs on Twitter.

All the ideas and governance posturing is great - but at what point are we going to get down to nitty-gritty everyday governance?

For example a few questions:

if a director had to be removed are there any conditions to limit putting forth that sort of proposal, or is it just another proposal in the system of governance?

Define the OP Holders section ‘those changes would reduce the rights of OP Holders in a material way’?

Can the Token House veto the Citizen’s House’s veto? If so what is the mechanism?

Roman Patronage vs Crypto Patronage

Patron - one that uses wealth or influence to help an individual, an institution, or a cause.

Roman society was also interesting to pull apart for it’s vast separations of wealth by the classes. The differences in monetary means between what we might consider poor, middle-class, rich, and billionaire is so vast versus the quality of life enjoyed by a senator vs. their lesser peers.

The basic breakdown in Rome with wealth examples:

Emperor (Elon Musk, Michael Saylor)

Senators (Barry Silbert, SBF, Vitalik)

Equestrians (Founders, OG traders, SHIB whales)

Plebeians (Spot holders, Disciplined traders)

Freedmen (Crypto.com users, Binance peeps)

Slaves

Wealth dispersion in Roman times was logarithmic, not proportional.

Today you might say Elon Musk is a 1%er; well the Emperor in Rome was like a 0.001%er and owned multiple gold mining regions for example.

It would be similar to a Token Holder having 1 BTC they grinded for over a year, and the Emperor would have millions of BTC, or more commonly a Senator would own large areas of all the land in Spain, but you might own a few homes in your entire family as an equestrian class member.

Every day if you were a man that had somehow escaped slavery from war, death from the multitudes of diseases, and avoided serving in the legions you would get up every morning and visit as many patrons as you could.

Every, single, day.

You see the wealth difference was so vast - that it was impossible to survive in Rome without taking on large amounts of debt in the hopes of moving upwards, and this required that many of the supposed middle classes of Rome - mainly equestrian class (below senator) would be so highly leveraged in debt, and business arrangements that just to survive day-to-day you would have to grab a few bucks from your local rich Senator. This was patronage and although after the Republic there was no needs for votes, it was still a sign of great success to show how many equestrians, freedmen, or slaves you could walk about town with. The higher class the better.

I would say that the comparison works with crypto because the chasm between levels of wealth is similar in it’s severity. In present day crypto your patronage is more likely to be alpha than money though.

Incentives

When speaking of Roman DAOs, or governance I’ve found that incentives seem to be what everyone is talking about. I mean constitutions and business roleplay are all fine and dandy, but how do we defeat the dreaded game theory scenarios, and how do we make sure that everyone gets paid with at least a shred of liberty?

First we start with the Tokenomics.

Problem #1: There is almost no incentive to write proposals if you have almost no chance of passing them without patronage from a whale, or large group.

Solution #1: Tribunes.

Tribunes solve this problem by allowing Token Holders to be involved in proposals. Tribunes are elected from the Token Holders and are able to easily choose the best proposals to put forward. Although not all proposals will be accepted by the tribunes - it is likely that the good ones will be put forward as the tribunes are elected by the Token Holders. Tribunes are also able to veto each other - so this protects from favoritism.

Normally there were about 10 Tribunes in any year, but this does not have to be a fixed number.

During Roman times tribunes generally did not veto each other and it was similar to tacit agreement you’ll see in sports leagues where NBA, or NHL teams don’t usually bid on each other’s restricted free agents even though they can. The reality is that even in game theory you need allies, and it’s usually not in your best interest as a tribune to further your career, by being a lone wolf - unless you can pull it off.

For example you might have a senator make a secret deal with a tribune off-chain and get the aforementioned veto they required, but this would come at the same risks that any sort of deal like this in TradFi would entail as well. Besides Zach would probably be all over it.

Problem #2: How do you hire for a Roman-style DAO?

Solution #2: Money.

This is obviously a bit tongue-in-cheek, but the reality is that the typical roles of a place like Jet Protocol would be hired in the same fashion that you would see today. The main difference in hiring would be:

how do you elect your tribunes?

how do you elect your first senators?

how do you elect a consul?

I’ve thought of this long and hard since talking to @P_H_B_D and it seems that one of the first assumptions will be that a solution can be found in the future where a sybil wallet attack could be defended against. The solution is I believe is … people.

While attempting to avoid a rat-on-your-neighbor-style enforcement system I believe it is possible to have people keep an eye on suspicious wallet behavior. Similar to how White Hat bug bounties work - if there is an incentive to weed out the cheaters, then there will be people willing to to win the rewards for finding said cheaters. The key is to always have proper tasks for any position - no matter how low down the ladder to prevent incentivizing -EV actions. Similar to the idea that underpaid cops will be more likely to accept bribes than properly paid cops. The Romans used this to great affect with their donatives and the rise of the professional soldiers, and if you were an Emperor that didn’t take care of your soldier’s pay…

Solution #3: Hidden Voting

I observed some people on CT throwing around the idea of Hidden Voting where you don’t display the vote totals for a DAO vote in progress. I’m sure this is not necessary all the time, but I can see this solving problems where large early voting can sway opinion, or create voter apathy where people feel their vote won’t matter. It’s extremely important I believe to kill this concept that large percentage of token holders not voting is no big deal. We need almost everyone voting, and I’m unsure if voting should almost be mandatory in some situations.

cursus crypto honorum

Latin for 'course of honors', or more colloquially 'ladder of offices'

You have to remember that Roman culture is extremely old:

before Jesus

before all that England stuff

warring states period in China

1000+ years

extremely diverse (Africa to England)

yes, I know it crosses over with Jesus - I mean they killed him ffs.

The key method that I use to get my head around Roman governance structures is that a lot of the positions are specific to the time period. The Romans - they farmed, and they fought wars.

So how do you go about organizing a bunch of ex-soldiers who want to be farmers, but also go to war if they must. The Roman men were the leftovers of the previous millennia’s wars (think Trojan Wars).

I’m in the process of gamifying a whole bunch of positions that would work in a small and large scale organization. Lictors below will be a part of it, but I think the next article will have to tackle the fundamental problems that some of my CT friends have discussed ad nauseum with each other. Similar to how using a well-crafted mobile app can keep you entertained for hours - I’ve always believed that product market fit can work with governance. Hell! Look at the success of STEPN($GMT). If people are willing to walk for pennies, they will sure as hell complete DAO tasks for the same amount. I’ve always felt this sort of system is possible and now with crypto it is.

The Crypto Honorum I will work on as I plug away at this series of articles. Trying to provide a more specific model so that people can test it out. Many parts need to be modernized, even more need to be thought through and applied to current issues in DAO apathy.

Lictors

The civil servants of Rome. Super weird AF. I think I’ll get into them more in part III.

Voting Tokens

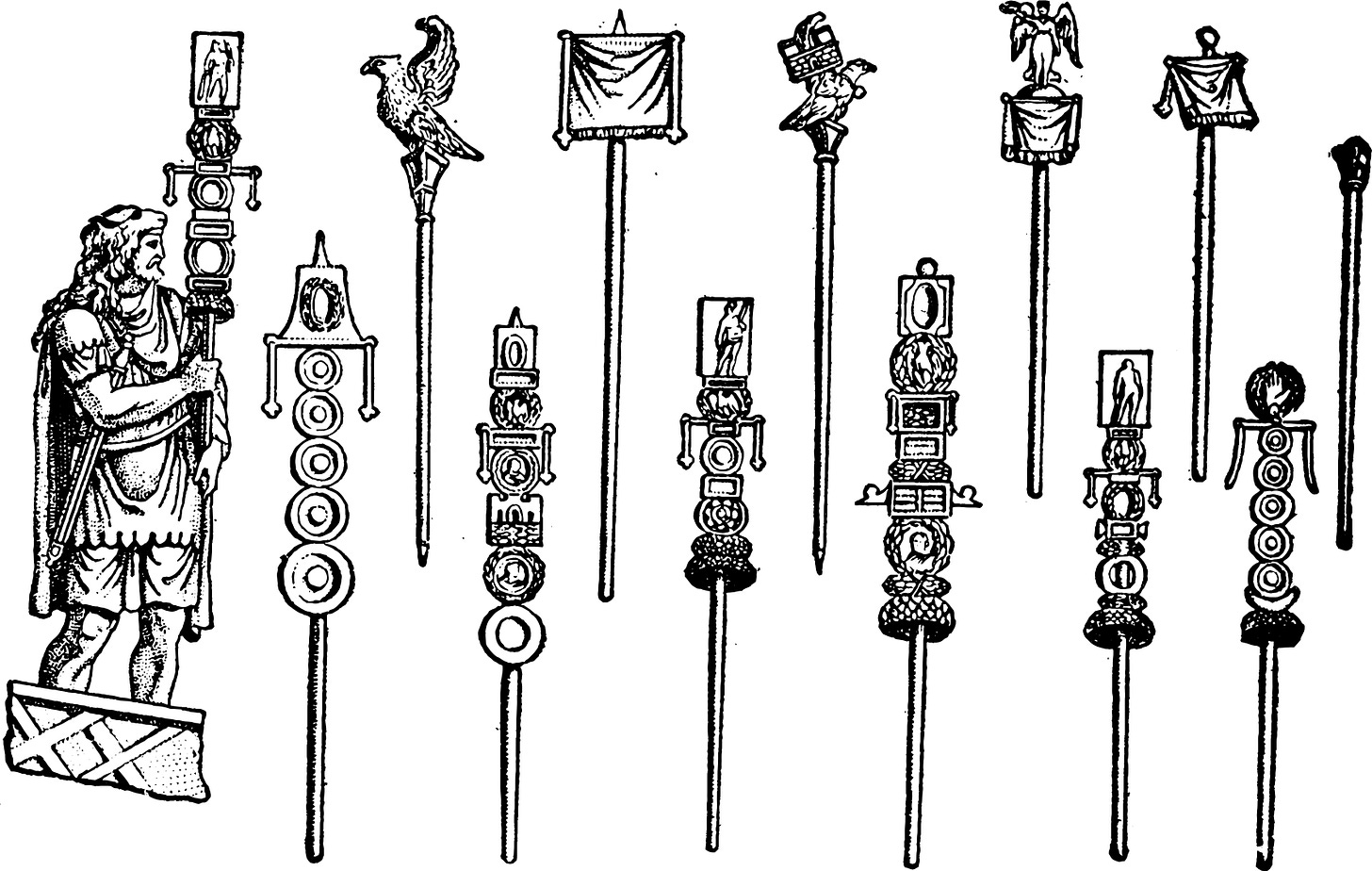

There has been talk of non-transferrable governance tokens that are strictly for voting.

Below are the staffs that I propose to be used as NFTs. Whether they have value or not will not affect the voting.

Quadratic Voting seems pretty straight forward after you read it from Vitalik Buterin. The man just makes it sound so straight-forward, but I believe I can grasp the idea of paying +n for every subsequent vote. It allows strong influence from big token holders, but allows for only a certain amount of control in the sense of votes for electing the tribunes(10). For example if ten tribunes required a certain amount of votes, I’m sure mathematically it would be extremely difficult to prevent the smallest group of token holders to have at least one tribune. That one tribune could veto any proposal going to the senate from the tribunes.

Since you are electing ten tribunes you can make some distribution predictions.

I’m going to warn you right now that I have no idea how to do distributions, and I’m hoping I’m either luckily on the right track, or corrected before this gets published. (Jack save me).

I believe that tribunes could also get randomly selected and choose whether or not to serve in the role, in fact they could even sell the role outright! The point is that some people want to run governance, and some people want to vote governance. Only via rigorous testing can we crack this nut.

What’s coming up Next?

Wrapping up this Roman Rules of Crypto Part II, I’m left with even more thoughts on applying Roman culture to crypto problems. I’ve been listening a lot about Diocletian, a Roman emperor from 284 to 305. He dealt with coin debasement, brutal inflation, overhauled the civil service, and let hard-liners brutalize the Christians. The man had a plan, and basically led the way to feudalism. I’m not lauding feudalism as an achievement. I’m simply pointing out that these centralized/decentralized governance problems have been going on for thousands of years, and I can’t shake the feeling that the solutions are in there, somewhere in ancient antiquity.

Thank you all very much for reading this far. If you missed Part I, please find the link at the top of the page.

Special thanks to all who have reached out and DM’d me. I’m always happy to talk about these sort of things, or provide encouragement.

-Bob